Canadian dealmaking fell ~40% in 2022 and is currently down ~50% from the same last year. Despite this, workers at the country’s top investment banks can sleep easy knowing their jobs are not in imminent danger.

Driving the news: Canadian investment banks aren’t expected to carry out mass layoffs like their American counterparts, industry executives and headhunters told Reuters, with some firms even considering boosting headcounts as they look to grow their global footprints.

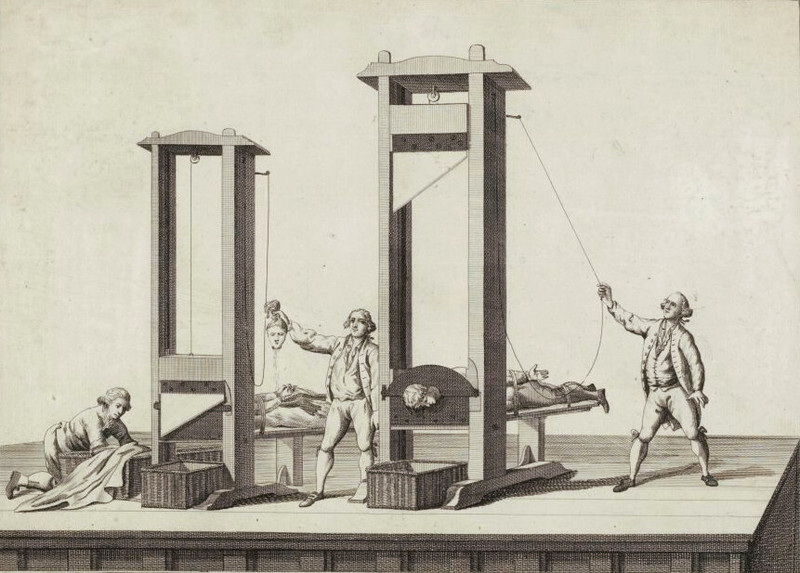

- Heads are rolling at US investment banks like the French Revolution with Wall Street titans like Goldman Sachs and Morgan Stanley deciding to cut over 15,000 jobs.

Why it matters: The reluctance to lay off bankers highlights some differences between the Canadian and American job markets. Canadian banks need to think twice about people left and right simply because the talent pool isn’t as deep. It’s also costlier, as Canadian labour laws for federally-regulated industries result in higher standards for severance packages.

- Reductions in salaries and bonuses could be seen as more practical cost-cutting measures than layoffs.

Zoom out: Banking isn’t the only industry safe-ish from layoffs. Plenty of sectors are looking for more workers, like healthcare and hospitality. Just look at Chipotle, which has plans to hire 15,000 employees across North America—of course burrito bowls are recession-proof.