Canada’s inflation rate is tracking down, but the 2% target is still a while away.

Driving the news: With the unemployment rate low and job vacancy rates high, workers are still leveraging a tight labour market to make up for lost purchasing power. But annual wage growth in December—down to 3.4% from 4%—shows upward pressure on wages is cooling.

- Last year, Bank of Canada Governor Tiff Macklem left some people in a tizzy when he suggested employers shouldn’t consider high inflation in their wage negotiations.

- T-Mack was worried about the ol’ wage-price spiral: When businesses and workers push up prices (inflation) and demand higher wages in a self-reinforcing cycle.

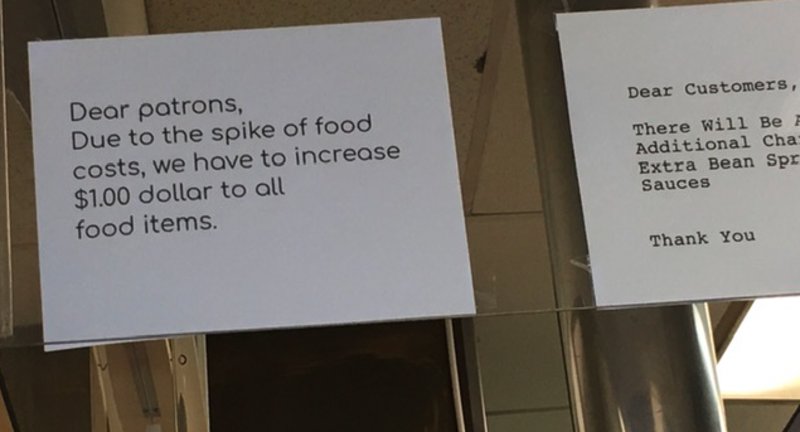

Why it matters: You can blame supply chain disruptions, pandemic support, and the war in Ukraine for inflation skyrocketing to four decade highs last June, but stickier measures (like the resulting wage growth) will also dictate whether inflation can fall to 2% by next year.

- There is a loose connection between wage growth and services inflation (an important measure) in Canada, which Macklem said he’s watching very closely.

Zoom out: Central bankers are playing somewhat of a rigged claw machine when it comes to the economy. No matter their economic smarts and determination to grab the target 2% inflation prize, some drivers (like the war in Ukraine) are completely outside of their control.