Is saving 50¢ on a bag of carrots enough to pay for an expensive trip or a luxury item? Probably not—but your brain might be telling you it is.

What's new: Canadians are scrimping on everyday expenses like food and transportation, which is normal when prices surge. But according to an RBC analysis, people aren't keeping that extra cash as a safety net—they're choosing to splurge instead, something experts call “revenge spending.”

- The RBC Spending Tracker shows that while overall spending has remained steady, consumers are sacrificing small pleasures to pay for big indulgences.

- Here's a good example: restaurant spending has fallen, but holidays, despite pricey airfares and accommodation, are up—so people are choosing to eat at home and using the cash they would have spent dining out on their vacations.

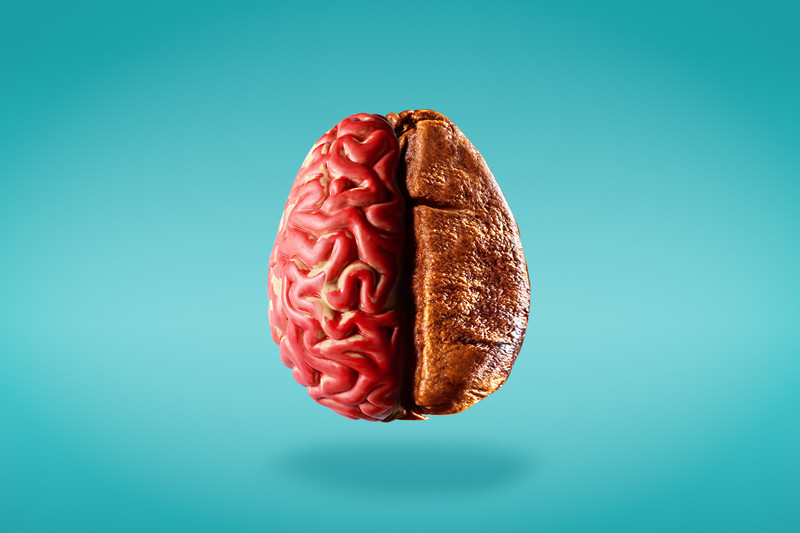

Why it's happening: The phenomenon driving the trend is called split brain budgeting—think of it as a little angel on one shoulder and a little devil on the other.

- The angel tells you to be responsible—inflation has made things more expensive and we don't know where the economy is headed, so the smart thing to do is save!

- But the devil is whispering in your ear that you deserve to go to Bali, and he justifies it by tallying up all those little saves, convincing you that you can afford a luxurious vacation even if you can’t.

Why it matters: Split brain budgeting just doesn't add up—saving a few bucks on groceries will not pay for an exotic getaway and leave room for savings.

Experts suggest that the key to reuniting the two sides of your brain is to take a day or two to think over a big-ticket item before you buy it. Run the numbers on what you can afford right now and look for more cost-effective alternatives.

Go deeper: Here are four ways you can resist the urge to splurge.