Like a university student with a full course load, Hydro-Québec has taken on too much and is running low on energy… literally.

All Energy stories

It’s been a minute since we’ve discussed Canada’s ambitions to become a leader in liquefied natural gas (LNG) exports. How are things going? Honestly, not great.

Tired of hearing about wind, solar, and hydrogen energy? You’re in luck. There’s a hot new renewable energy source on the scene that is literally so hot.

As Canada ramps up efforts to meet its lofty decarbonization goals, the country’s oil sands are scrambling to keep up.

The (figurative, economic) storm clouds are starting to break in Europe as peak inflation has come and gone—thanks to sliding natural gas prices.

Wouldn’t you love to fly across the world knowing you weren’t also contributing to climate change? Well, soon that dream could become a reality.

Solar power will overtake coal as the world’s largest source of electricity by 2027, according to a new International Energy Agency (IEA) report.

Why it matters: The rapid growth of solar power as a part of the world’s energy mix (it accounted for less than 1% of power capacity in 2010) is revolutionizing how the world generates its electricity.

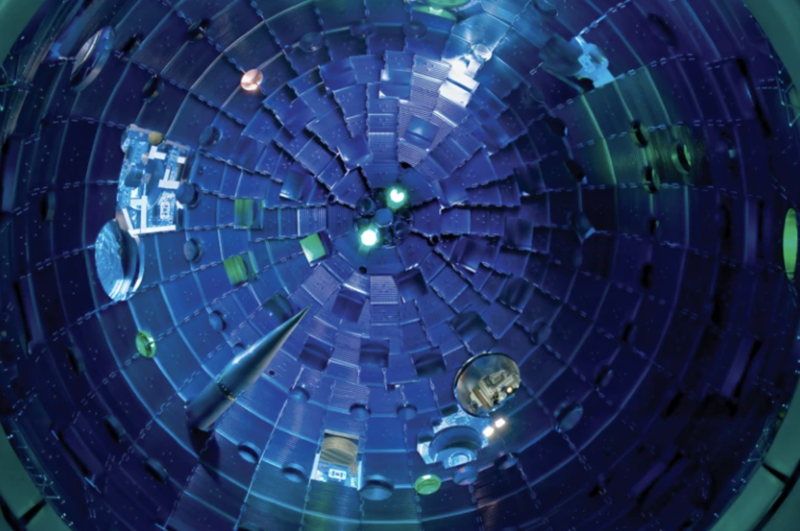

The promise of abundant, clean, and cheap energy has been a staple of sci-fi forever, but a breakthrough by scientists at a US laboratory could make that dream a reality.

What happened: A team of researchers at California’s Lawrence Livermore National Laboratory generated a net energy gain in recent fusion experiments, per the Financial Times.

Western efforts to starve Russia of its oil revenue kick into a new gear today with a double-pronged attack on its energy exports.

Driving the news: A European ban on the seaborne import of Russian oil came into effect today, along with a G7-imposed price cap meant to stop other countries from buying Russian oil at high prices.